Every investor has a different goal. Some focuses on cash

flow, i.e. how much to get every year, but me? I think appreciation is one goal

of investment, and the main goal for long-term investment.

During the initial stage of investment, I had other stable

incomes like employment income, so my target at that time was to pay less tax

and gain more capital. There’s no income tax when you don’t actually get money into

your pocket, and you don’t need to pay tax on capital gain until you sell the

property, so at that time, the appreciation of the house is your gain and you

don’t need to pay tax for it.

In order to achieve the goal of utmost capital gain and

least tax, we need to take great advantage of using leverage, which means borrow

as much money as possible. However, high leverage comes with high risk and excessive

negative cash flow may bring you financial pressure, thus the recommended down

payment for investment real estate purchase is 25%, with loan-to-value ratio of

75%. This ratio keeps the risk and cash flow both at a balance. When down

payment is less than 25%, banks think risk gets higher, so it costs more to get

a loan. If you can afford a relatively higher risk, you could find mortgage

products with only 15% or 20% down payment.

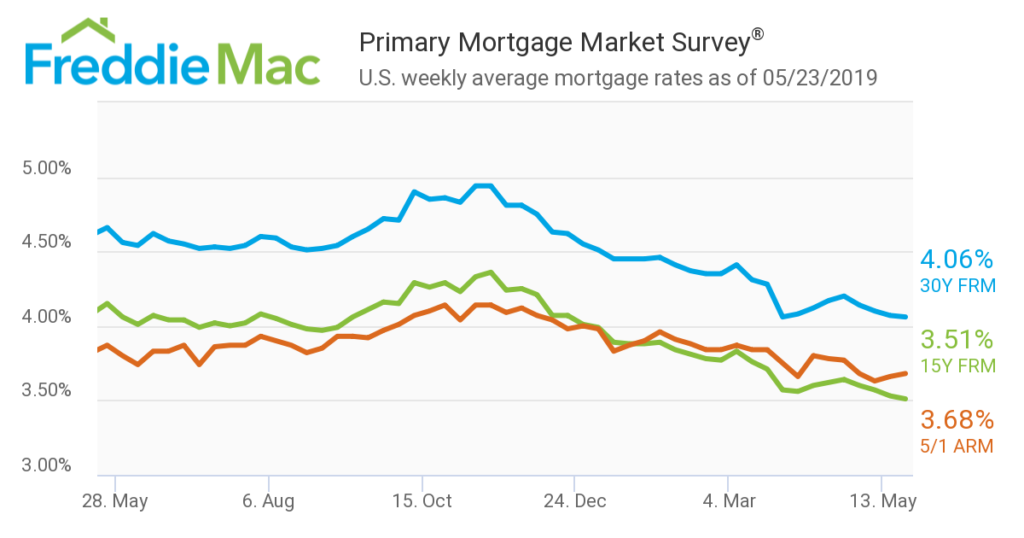

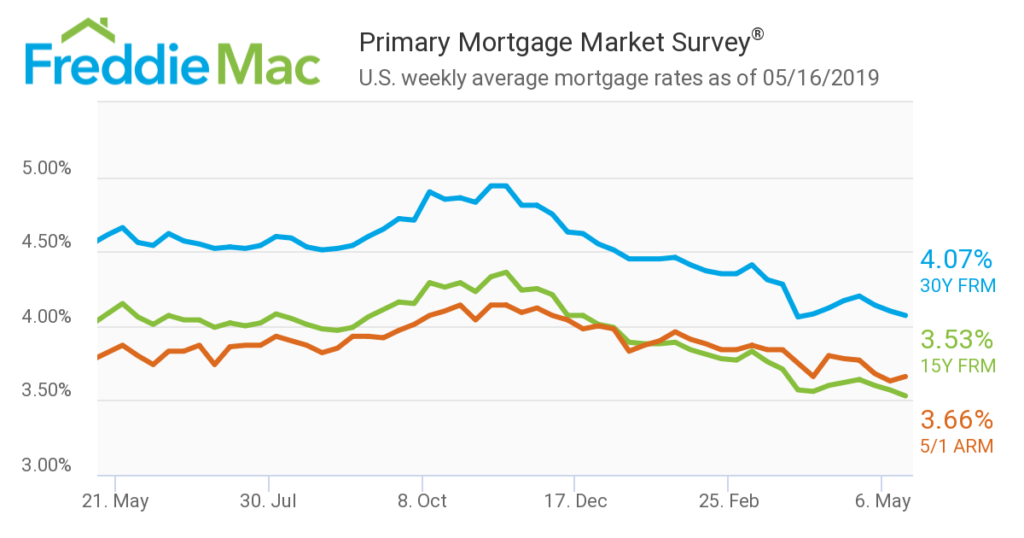

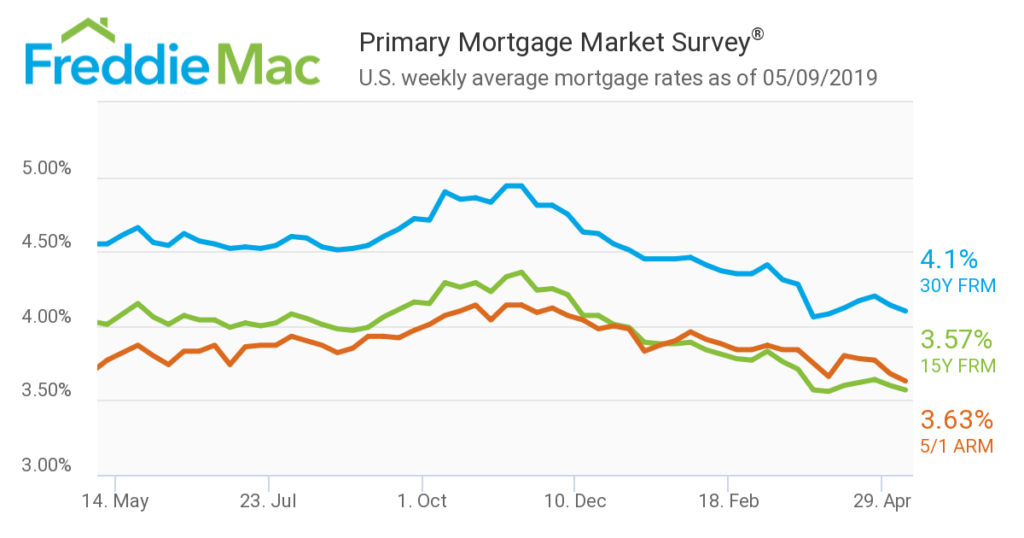

It is actually Fannie Mae and Freddie Mac that recommend

investors to put 25% down. With this down payment, rate is very competitive. Most

real estate properties with 25% down payment can still have a little bit positive

cash flow nowadays. When I started to purchase investment properties in more

than a decade ago, that number was 20%, so most of my investment properties were

purchased with 20% down payments. When the value of the real estate increased

by 5%, my equity increased by 25% (5 *5%). This is how leverage works. Of course

when real estate’s price goes down, the equity decreases by five times as well.

For example, I purchased a property with $20,000 down payment and loaned

$80,000. When this house’ value increase 5% after a year, which is $5,000, the

principal balance is a little bit less than $80,000, and the equity turns from

$20,000 to $25,000, the increase is $5000/$20,000 = $25%.

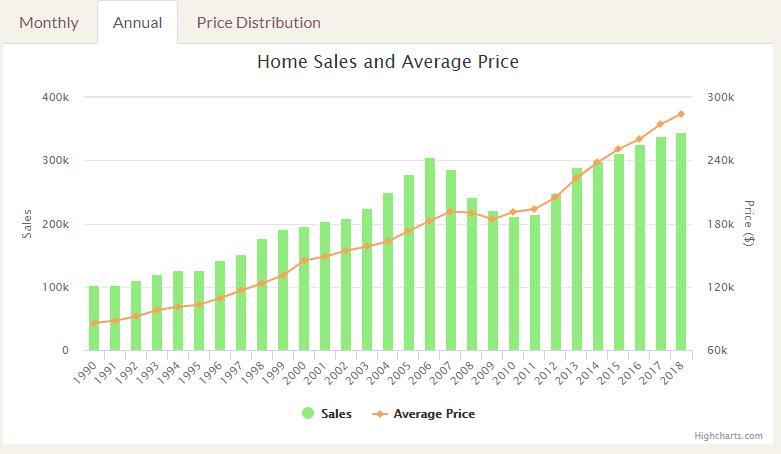

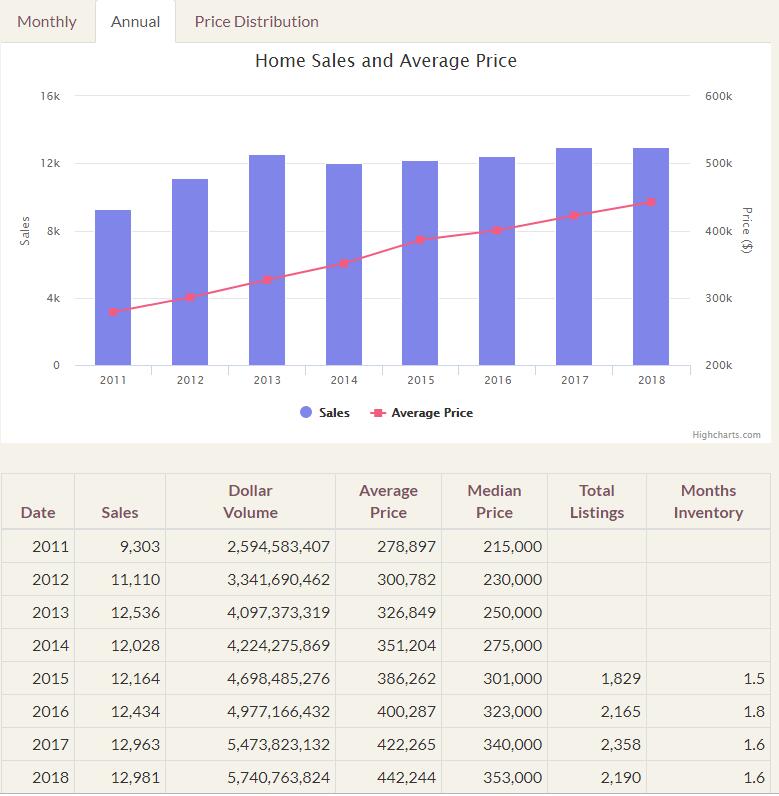

For the past several years, the average real estate appreciation

is 5% per year for Austin and most cities of United States.

A few decades later, when we need cash flow income to

support daily life (usually it’s when we retired), the loan-to-value ratio

needs to stay relatively low. Let’s say now we pay 25% to purchase a property,

in 15 or 20 years, house value should be increased by 2 to 4 times, mortgage

principal balance becomes low and rent amount increases. In today’s Texas’

market, if you use cash to purchase, the cash flow should be between 4% and

10%, which is much better than investing money into stock market. Besides cash

flow, the annual average appreciation is about 5%, based on past 30-year’s

statistics. The appreciation part can be regarded as saving, and its increase

rate should follow the changes of inflation, because essentially the property

is about land, labor, steel, wood and etc.

A general principle is since we plan to keep the investment

for 15 to 20 years, even the initial cash flow is low or negative with 25% or

20% of down payment, in a few years, it should become positive and eventually a

nice source of income.

We will talk about how to reduce risk in following articles.

Reference: http://www.multpl.com/s-p-500-dividend-yield/table