Many articles have mentioned that unless the ROI (Return on Investment) is more than 10%, or the rent rate is at least 1% of the house price, the investment is not worth doing. However, is that really the case? Let’s take a look at a typical rental property in Austin suburb which is around $200,000 in value.

- House price: $210,000

- Down payment: 25% of the price ($52,500)

- Mortgage amount: $157,500

- Closing costs: $3000 (roughly)

- Mortgage rate: 4.75% (30-year fixed mortgage)

- Mortgage payment: $821.59 (principle and interest)

- Property tax with tax rate at 2.7%: $472.5/month

- Property Hazard Insurance: $50/month

- Homeowner Association Due: $35/month

Total: $1379/month

In order to have a 10% ROI, the annual net profit has to be at least $5550, which equals $462.5 profit per month, so the rent amount has to be at least $1841.5. Then if we take repair and vacancy into consideration, the rent needs to be above $2000; however, in reality, the average rent for this kind of rental in the Austin suburb area is around $1600. As a result, investors usually set their eyes on properties with poorer conditions in order to have a “high return”. Those properties require frequent maintenance and unless investors spend a lot of time and money to fix them, the return will be even less. Sometimes we do find properties with high return, but we need to personally invest time and money on it in order to see those returns. I have a friend who is a new immigrant and doesn’t speak very much English. He sold his house in his hometown and purchased a few properties when he came to U.S. Those properties are all around $100,000 in value, with monthly rent above 1% of house price. The houses require much attention, but my friend is very handy. He hired people who didn’t speak English (only Spanish) to work with him on fixing those properties, and managed to have his investment pay off. However, those properties are difficult to find now and I don’t think this model fits everyone as it requires too much energy and time to be invested alongside the initial financial investment. So someone who still wants to have time for their own life, business and family may not find this type of investing plausible.

From my experience, there’s actually no need to have at least 10% ROI at the very beginning. Like I said, if you could break even at the time you completely own this property, which usually means in a period of 15 to 20 years, your rental income will cover all your expenses such as mortgage, tax, insurance, HOA, repair and etc. The return would be, in fact, pretty good in this case. Even with negative cash flow in the first few years, you will have positive cash flow in the next few years because the rental rate will increase due to inflation.

Of course, I am not saying that you should avoid or ignore high return investments. The problem is a lot of these kind of investors are trapped in on-going repairs and end up losing money because the repairs are expensive and they can’t do it themselves.

Many friends of mine regret not purchasing more properties 10 to 20 years ago. The returns on any properties that were purchased 10 to 20 years ago are good, even for those which were purchased in 2007 or 2008 (when the house price was at a high point). Unfortunately, we do not have a time machine to go back and make those investments, but I do believe that if you invest right now, you will see good returns in 10 to 20 years. The thought of not able to find a property with good ROI or cash flow is incorrect. There are lots of properties on the market that can bring an average of 20% return annually in 10 to 20 years, in my opinion, and their risks are relatively low. My calculation is based on an assumption that housing inflation will continue. The common calculation method that our government uses doesn’t apply to real estate. When we say the annual inflation is about 3%, do you know how much the real estates in Texas have increased? This is why we need to study the history of inflation.

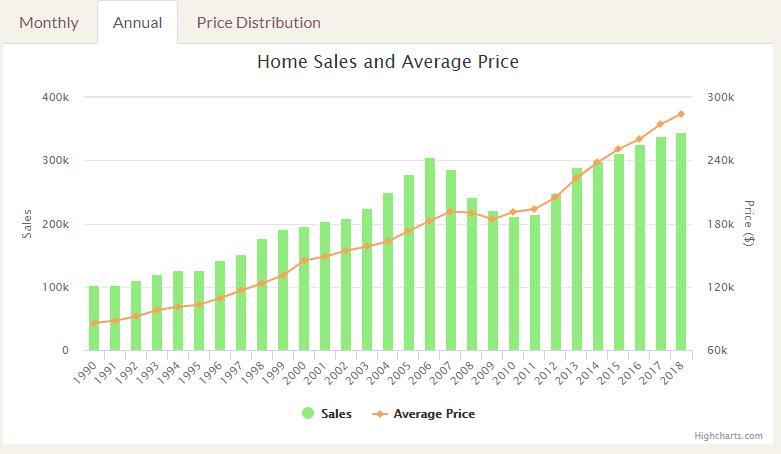

Below is the Home Sales and Average Price history chart (Texas) found on the website of Texas A&M University Real Estate Research Center.

The average house price of Texas in 2008 was $190,280 and $284,033 in 2018, an almost 50% increase.

Next is the chart for Austin area.

The average price of a property was $278,897 in 2011 and $442,244 in 2018, a nearly 60% increase.

We all know that house price will be up and down, however, if you look at the long term, you will see the price actually keeps increasing. In the next chapters, I’ll talk about why you should invest in Texas and when to buy.